nebraska sales tax rate changes

Motor Fuels Tax Rate. Municipal governments in Nebraska are also allowed to collect a local-option sales tax that ranges from.

5 Essential Steps To Reform Taxes In Nebraska

The original state sales tax rate was 25 percent.

. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. The Nebraska NE state sales tax rate is currently 55. The Nebraska state sales and use tax rate is 55.

536 rows Nebraska Sales Tax55. This is the total of state county and city sales tax rates. Average Sales Tax With Local.

Nebraska Department of Revenue. 18 rows Over the past year there have been eighteen local sales tax rate changes in Nebraska. 2024 LB 873 reduces the corporate tax rate imposed on Nebraska taxable income in excess of 100000 for taxable years beginning on or.

As of January 1 2019 Nebraska requires certain out-of-state businesses to collect and. 31 rows Nebraska NE Sales Tax Rates by City The state sales tax rate in Nebraska is 5500. This table lists each changed tax jurisdiction the amount of the.

Nebraska sales tax changes effective July 1 2019 Several local sales and use tax rate changes take effect in Nebraska on July 1 2019. Corporate maximum income tax rate change. It has changed 13 times since then and is now 55 percent 6.

Nebraskas Local Sales Tax Many Nebraska cities levy local. There is no applicable county tax or special tax. Groceries are exempt from the Nebraska sales tax Counties and cities can charge an.

New local sales and use taxes. Several local sales and use tax rate changes will take effect in Nebraska on April 1 2019. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information.

The Nebraska state sales and use tax rate is 55 055. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up. FEBRUARY 25 2021 LINCOLN NEB Tax Commissioner Tony Fulton announced the following changes that will be effective as of April 1 2021.

More 2022 Nebraska Sales Tax Changes Over the past year there have been eighteen local sales tax rate changes in Nebraska. In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments. The Nebraska sales tax rate is currently.

Coleridge Nehawka and Wauneta will each levy a new 1 local sales and use tax. The minimum combined 2022 sales tax rate for Nemaha Nebraska is. Local sales and use tax increases to 2 bringing the combined rate to 75.

Several local sales and use tax rate changes will take effect in Nebraska on July 1 2019. With local taxes the total sales tax rate is between 5500 and 8000. 800-742-7474 NE and IA.

A new 1 local sales and use tax is being imposed in the. Coleridge Nehawka and Wauneta will each levy a new. Nebraska has a statewide.

Nebraska has a statewide sales tax rate of 55 which has been in place since 1967. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska. You can print a 725 sales tax table here.

Fordyce will start a. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax.

Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare

Fuel Taxes In The United States Wikipedia

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Nebraska Sales Tax Rate Changes April 2016 Avalara

Nebraska Tax Reform Framework Would Improve Competitiveness

Sales Taxes In The United States Wikipedia

What Is Sales Tax A Complete Guide Taxjar

General Fund Receipts Nebraska Department Of Revenue

Taxes And Spending In Nebraska

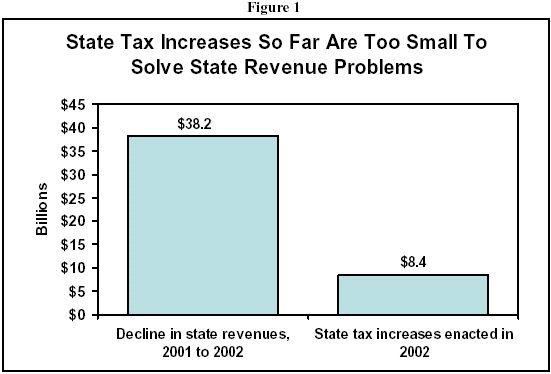

The State Tax Cuts Of The 1990s The Current Revenue Crisis And Implications For State Services 11 12 02

Taxes And Spending In Nebraska

Sales Tax By State Is Saas Taxable Taxjar

How High Are Cell Phone Taxes In Your State Tax Foundation